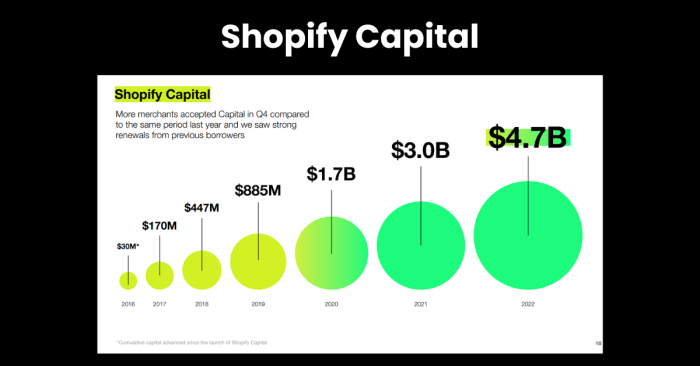

When it comes to growing your ecommerce business, choosing the right Shopify Capital loan is crucial. Let's dive into the key factors, types of loans, application process, and more to help you make an informed decision.

Factors to Consider

When choosing a Shopify Capital loan for your ecommerce growth, there are several key factors that you should take into consideration to make an informed decision. Factors such as interest rates, repayment terms, loan amounts, and your business's financial health and growth projections play a crucial role in determining the most suitable loan option for your specific needs.

Interest Rates

Interest rates are a significant factor to consider when selecting a Shopify Capital loan. Lower interest rates can help you save money on the overall cost of the loan, making it more affordable for your business. Compare the interest rates offered by different loan options to choose the one that aligns with your budget and financial goals.

Repayment Terms

The repayment terms of a loan dictate how long you have to repay the borrowed amount along with any interest accrued. Consider the repayment schedule that works best for your business's cash flow and revenue projections. Longer repayment terms may result in lower monthly payments but could also lead to paying more in interest over time.

Loan Amounts

The loan amount you qualify for can impact your ability to fund your ecommerce growth initiatives. Ensure that the loan amount is sufficient to cover your expansion plans without burdening your business with excessive debt. Assess your capital needs carefully to determine the appropriate loan amount for your specific requirements.

Financial Health and Growth Projections

Assessing your business's financial health and growth projections is crucial when choosing a Shopify Capital loan. Understanding your current revenue, profitability, and future growth potential can help you determine the amount of financing you need and whether you can afford to take on additional debt.

Consider your business's ability to repay the loan and how it fits into your long-term growth strategy.

Types of Loans

When considering a loan through Shopify Capital for your ecommerce business, it's essential to understand the types of loans available to make an informed decision that aligns with your business needs.

Short-term vs. Long-term Loans

Short-term loans typically have a quicker repayment period, usually within a year, and are ideal for businesses looking for immediate funds to cover expenses or seize growth opportunities. On the other hand, long-term loans offer a more extended repayment period, often several years, providing businesses with more flexibility in managing cash flow and larger investments.

- Short-term Loans:

- Benefits:

- Quick access to funds

- Helps cover immediate expenses

- Drawbacks:

- Higher interest rates

- Shorter repayment period

- Benefits:

- Long-term Loans:

- Benefits:

- Lower interest rates

- Extended repayment period

- Drawbacks:

- More stringent eligibility criteria

- Accumulated interest over time

- Benefits:

Eligibility Criteria

The eligibility criteria for each type of loan offered through Shopify Capital may vary based on factors such as credit history, revenue, and business performance. Understanding these criteria is crucial in determining which loan type aligns best with your business's needs and financial capabilities.

Application Process

When applying for a Shopify Capital loan for your ecommerce growth, the process is designed to be straightforward and user-friendly. Here's a breakdown of the steps involved and some tips to help you prepare for a successful application.

Steps to Apply for a Shopify Capital Loan

- Create a Shopify account if you don't already have one.

- Check your eligibility for a loan by reviewing the criteria set by Shopify.

- Access the Capital page on your Shopify dashboard and click on "Apply Now".

- Provide the necessary information about your business, such as revenue, sales history, and growth plans.

- Review the loan offer provided by Shopify and accept the terms if you agree.

- Once approved, the funds will be deposited directly into your bank account within a few business days.

Tips for a Smooth Application Process

- Ensure your Shopify account is up to date with accurate business information.

- Have your financial documents ready, including bank statements, tax returns, and sales reports.

- Be prepared to explain how you plan to use the loan to grow your ecommerce business.

- Double-check all the information provided before submitting your application to avoid delays.

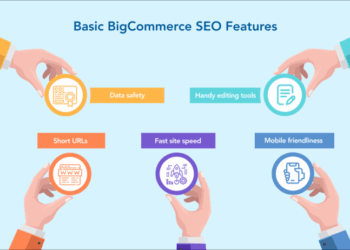

Shopify vs. Traditional Lenders

One of the key advantages of applying for a Shopify Capital loan is the streamlined process compared to traditional lenders. Shopify leverages the data already available on your ecommerce platform to assess your eligibility and offer personalized loan options, eliminating the need for extensive paperwork and lengthy approval processes.

This simplification allows you to focus on running your business rather than getting bogged down in loan applications.

Approval and Disbursement

When it comes to getting approval and receiving funds for a Shopify Capital loan, timing is crucial for your ecommerce growth. Let's dive into the process to understand how it works.

Timeline for Approval and Disbursement

Once you apply for a Shopify Capital loan, the approval process can typically take anywhere from a few days to a couple of weeks. The speed of disbursement largely depends on how quickly you provide the necessary documentation and information requested by Shopify.

Once approved, funds are usually disbursed directly into your Shopify account within a few business days.

Factors Impacting Speed of Approval and Disbursement

Several factors can impact the speed of approval and disbursement of funds for your Shopify Capital loan. These factors include the completeness of your application, the accuracy of the information provided, your business's financial health, and Shopify's current processing times.

Ensuring that you have all the required documents ready and that your financial records are in order can help expedite the process.

Best Practices for Managing Finances Post-Approval

Once your loan is approved and funds are disbursed, it's essential to have a clear plan for managing your finances effectively. Some best practices include:

- Creating a budget to allocate the loan funds strategically towards areas that will drive growth.

- Tracking your expenses to ensure that the loan is being used wisely and in line with your business goals.

- Making timely repayments to maintain a good credit history and eligibility for future financing.

- Regularly monitoring your financial performance to assess the impact of the loan on your ecommerce growth.

Last Point

In conclusion, selecting a Shopify Capital loan that aligns with your business goals and financial needs can set you on the path to success in ecommerce. Make sure to consider all the aspects we've discussed to make the best choice for your growth.

FAQ Summary

What factors should I consider when choosing a Shopify Capital loan?

Consider interest rates, repayment terms, loan amounts, and your business's financial health and growth projections.

What are the different types of loans available through Shopify Capital?

Shopify Capital offers various types of loans, including short-term and long-term options.

How can I simplify the loan application process with Shopify?

Shopify simplifies the application process compared to traditional lenders by streamlining documentation and information requirements.